How can i be eligible for a keen FHA Financial?

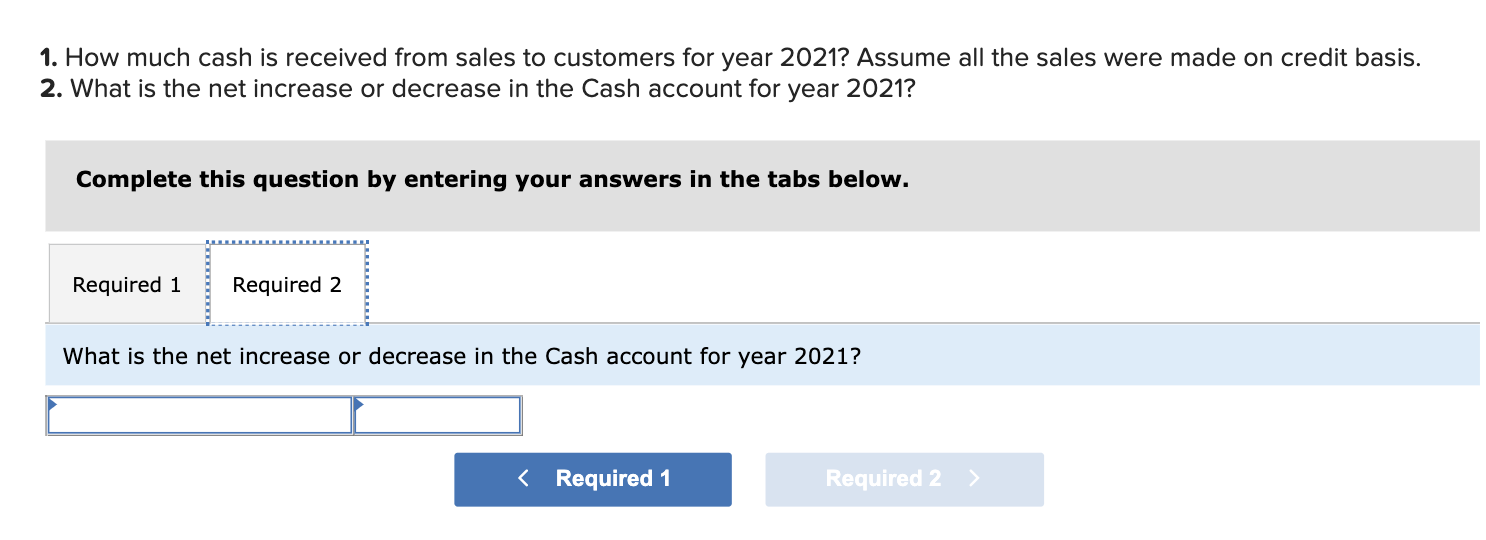

Prepared to get your first household? Handling tight budget or currency getting a down payment? A government-insured Federal Property Government (FHA) Mortgage has been helping anybody get homes since 1934, and you may Midwest BankCentre is actually happy giving so it substitute for local customers.

FHA Lenders are mortgages covered from the FHA, which makes them significantly more open to individuals having straight down fico scores and you can down-payment limitations. In order to qualify for an enthusiastic FHA Financial, you really need to meet what’s needed, along with regular a job, and you can a manageable obligations-to-money proportion. At the same time, you will have to deliver the requisite files to display your qualification.

FHA Financial standards.

When trying to get a keen FHA financing, it is important to understand that there are a few FHA financing limits considering place.

Possible safer an FHA financial that have an excellent straight down credit history than simply a normal financing, with more strict standards. Minimal get varies according to the lender otherwise mortgage manager, making it possible for even more owners to truly have the imagine home ownership. Since there is zero lowest criteria, the likelihood of acceptance improve that have increased credit history, combined with earnings and you can a career points. FHA mortgage brokers have financing restriction that’s based for the urban area. For additional information on FHA requirements, contact one of the financial officers to discuss your unique financial disease.

An effective option for basic-time homebuyers.

FHA Loans are often used to help people who want the fresh new possibility to set less of your budget upon a house. From the low-down fee, FHA Finance will likely be good for very first-time homeowners, and people who have smaller-than-finest borrowing.

FHA individuals pay a month-to-month top (MIP) like home loan insurance policies. So it covers the lending company from loss when the a borrower defaults into the financing, and you will homebuyers must inform you evidence of money so you can be considered.

Midwest BankCentre, a federal Casing Administration-acknowledged bank, has actually canned FHA fund to own borrowers all over the usa. The state of Missouri now offers assistance software to have earliest-big date homeowners, and grants, finance, down-commission assistance, and you may income tax credits. Assist a professionals make it easier to through the processes.

Our very own Faqs shelter extremely important info instance eligibility standards, down-payment conditions, loan limitations, and much more. Regardless if you are not used to your house to get techniques otherwise seeking to refinance, loans in Granby we have been right here so you’re able to know how FHA money can work for your requirements. When you yourself have most inquiries or you need suggestions, our very own home loan professionals will be ready to let.

Each other choice give you the same rate of interest balance, although 15-year label keeps high monthly premiums, providing a faster treatment for build household security. You can use it higher collateral once the a down-payment when your move to your upcoming domestic. Certain FHA Fund has actually amount borrowed hats and you may differ based on place.

Maximum loan amount for a keen FHA Home loan may vary mainly based for the precise location of the assets. The new Federal Homes Administration establishes mortgage limits per year, looking at regional housing market criteria. This type of limitations usually echo the fresh new median home values into the per town. It is vital to consult with a home loan banker otherwise use online resources to search for the certain FHA loan maximum applicable so you’re able to their desired property place.

FHA Improve refinancing try a simplified process made to assist FHA borrowers reduce their home loan repayments and interest rates. Some great benefits of FHA Streamlined refinancing were limited files standards, no assessment demands, additionally the capability to re-finance without re-being qualified for borrowing from the bank or money. This will make it a convenient option for consumers who want to benefit from straight down rates otherwise lose the monthly mortgage money versus detailed records.

Sure, you should use a keen FHA 203(k) Rehabilitation Financing to invest in the acquisition and restoration away from an excellent fixer-higher property. That it certified FHA mortgage system lets consumers to combine the price out of household buy and you may solutions towards an individual financial. It offers finance for both the purchase of the house and this new renovation performs, it is therefore an appealing choice for people looking to help the position from a home when you’re funding it.

Apply for a keen FHA Loan now!

Midwest BankCentre is actually an enthusiastic FHA bank while offering FHA Lenders so you can citizens on the Midwest. Our mortgage experts live and you may really works here, making them very familiar with your local housing industry and providing a competitive home loan speed. We have been in a position help you get an educated regional FHA financial financing for your requirements.

![Daniël Klijn [LittleDean]](http://www.littledean.nl/wp-content/uploads/2018/10/cropped-Littledean-LONG-wit-1-1-1.png)