How come new Salary Defense System impact the federal income and product profile (NIPAs)?

This new Income Safety Program (PPP) brings forgivable finance to greatly help small enterprises and nonprofit associations impacted by COVID-19 pandemic and you can economic downturn build payroll and you will defense most other expenditures. The application form was signed up 1st of the Coronavirus Support, Recovery and you will Economic Shelter Work (CARES) out-of 2020, modified from the next laws, and you may reauthorized by the Coronavirus Impulse and you can Rescue Supplemental Appropriations Act regarding 2021. 1

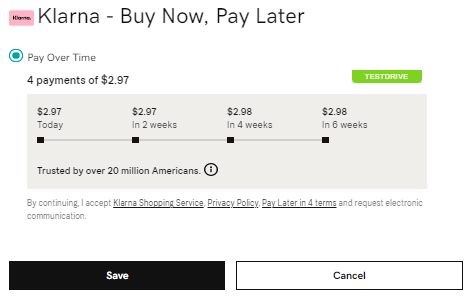

All loan money are deferred for 10 months

The new money try given because of the financial institutions or any other credit associations. The federal government will pay this new lending associations fees for these features. On NIPAs, the brand new costs try submitted because the nondefense consumption predicated on study from the small Team Administration toward loan approvals plus the program’s payment build.

Under the CARES Act, smaller businesses, including the worry about-employed, can take away financing around $ten billion which you can use for approximately 6 months of mediocre monthly payroll costs on the a year ago. Around forty percent of mortgage are used for non-payroll expenditures, such as for example most home loan desire, lease, and utility will cost you. The loans is actually for 5 decades and also have a-1 per cent fixed interest. All the costs was deferred to own 6 months; not, attract will accrue inside the deferral several months.

Finance tends to be forgiven whether your mortgage is used having payroll, attention money for the mortgages, rent, and you can resources. Yet not, extent that’s forgiven would-be faster proportionally from the low-exempted decreases about amount of chose staff compared to the prior 12 months or a 25 percent otherwise higher reduction https://cashadvanceamerica.net/loans/law-school-loans/ in staff compensation.

Beneath the Coronavirus Reaction and you may Recovery Extra Appropriations Operate away from 2021, forgivable funds to help you basic- and 2nd-day small company consumers come from PPP. Qualification are offered to have nonprofits and loyal finance are around for very small people and you can neighborhood-depending loan providers. Second-go out finance try restricted to businesses that have fewer than 3 hundred teams you to definitely knowledgeable at the very least a 25 percent shed in the disgusting invoices for the an excellent 2020 one-fourth than the same quarter in the 2019. The utmost financing dimensions getting 2nd-big date borrowers is $2 million.

The fresh new Western Save your self Package Work regarding 2021 considering a supplementary $seven.25 mil inside funding with faster stringent access standards to possess nonprofit agencies, electronic news organizations, just people, independent contractors, and you can notice-employed somebody.

PPP finance can be used to shell out qualifying expenses, that have been longer to provide expenses such as for example safeguarded possessions wreck, vendor will cost you, otherwise employee security expenditures plus staff earnings otherwise operating costs such as for example lease and you can resources. When used in qualifying expenditures, PPP fund meet the requirements to own forgiveness. Another modification on the modern PPP would be the fact consumers may now buy the length of their shielded months, off no less than no less than eight days so you can an optimum away from 24 days.

From the NIPAs, PPP finance in order to businesses that try forgiven are known as a great subsidy on the employers. Though applied since the good “loan”, all round purpose is the fact these loans would-be forgiven in the event that brand new program’s requirements try fulfilled. Efficiently the structure of one’s program is meant to make certain compliance with the terms of use on funds. Regarding the NIPAs, PPP loan subsidies so you can nonprofit establishments serving house are classified as a social benefit payment.

BEA’s group out of monies flowing through this program while the subsidies comprehends these costs service keeping organizations afloat and you may retaining group to help you manage newest production or to lso are-discover more easily when enabled. BEA’s 1st rates of your own subsidies, which suppose a certain part of the fresh new fund was forgiven, ount out-of mortgage forgiveness relies upon the tiny Providers Government. Finance that are not forgiven might be addressed given that regular fund on the national account, which happen to be classified given that financial transactions and get no direct affects with the NIPAs with the exception of interest streams.

BEA makes monthly quotes from money playing with accounts regarding mortgage approvals regarding Business Government

New fund are made to pay for costs across the time specified of the regards to the loan, and so the quotes from subsidies to possess organizations and benefit money having nonprofit associations from the NIPAs was designated along side same several months. This type of month-to-month values was after that modified to help you be the cause of enough time ranging from financing approval and you can disbursement, and are delivered along the period included in the loan. The fresh new allowance between business providers, non-corporate organization, and you may nonprofit establishments is dependant on addiitional information from the Brief Team Government.

Subsidies try good subtraction regarding calculation out of GDI due to the implicit inclusion in working extra (proprietors’ income and you can corporate earnings), and you may conceptually don’t have any web effect on GDI (NIPA table 1.10); government preserving (NIPA table 3.1) was less once the subsidies and work for money so you can nonprofit establishments are included in government expenditures

To own factual statements about the newest rates throughout the NIPAs, get a hold of “Aftereffects of Chosen Government Pandemic Impulse Applications into the Private Earnings” and “Aftereffects of Picked Government Pandemic Reaction Software on the Federal government Invoices, Expenditures, and you may Protecting” in the Federal Healing Applications and you may BEA Statistics: COVID-19 and you can Recuperation.

The next advice (from the chart less than) show the latest impact of the PPP toward GDI to own a corporate that attempts to look after a career. Example 1 shows an instance in which a corporate does not found an effective subsidy. Analogy dos illustrates a situation where a corporate obtains an excellent subsidy. Several months step one stands for a time period of normal operations, if you find yourself Several months dos suggests the firm since signed.

In advice, you can understand the decrease in GDI ranging from these two symptoms. Although not, the new affect GDI is the same in the Several months 2 — no matter whether there can be a great subsidy.

In essence, brand new subsidy in the Several months dos transmits the cost of a career in order to the us government and offsets the fresh new decline in web operating extra. There isn’t any improvement in compensation just like the precisely the supply of money changed.

Analogy dos: Subsidy inside the Several months dos Period 1 – Normal Team Businesses: Business enjoys 101 conversion, 100 payment costs, 0 subsidy Months dos – Team Signed: Business keeps 0 sales, 100 compensation costs, 100 subsidy

1 The latest Coronavirus Services, Rescue and you can Monetary Security Act (CARES) of 2020 authorized $350 Million, just like the Income Safeguards System and you can Medical care Enhancement Operate out of 2020 registered $310 Mil for finance from the Income Safeguards System. The fresh new Paycheck Coverage System Independency Operate (PPPFA) changed numerous arrangements of system, also extending the time assigned to explore PPP money from eight so you can twenty-monthly, reducing the amount of financing required to be taken to the payroll from 75 per cent to sixty percent, and increasing the exemptions for decreases in lead matters towards mortgage forgiveness criteria. The application finished on the immediately following disbursing $525 mil from inside the fund. Brand new Coronavirus Impulse and you may Recovery Supplemental Appropriations Operate from 2021 signed up $284 billion having money as a consequence of a modified types of the PPP.

![Daniël Klijn [LittleDean]](http://www.littledean.nl/wp-content/uploads/2018/10/cropped-Littledean-LONG-wit-1-1-1.png)