Absorption Costing What Is It, Vs Variable Costing

Tools like Katana help address these challenges, providing real-time insights into inventory, assisting with inventory optimization, offering scenario analysis tools, and automating cost tracking. Therefore, it is necessary to analyse and evaluate the pros and cons of the process and then decide whether it is suitable for the business. The company management should use it with diligence and responsibility so as not to create any negative effect in the decision making process. These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license.

Inventory Accounting Essentials: Managing and Recording Inventory Transactions

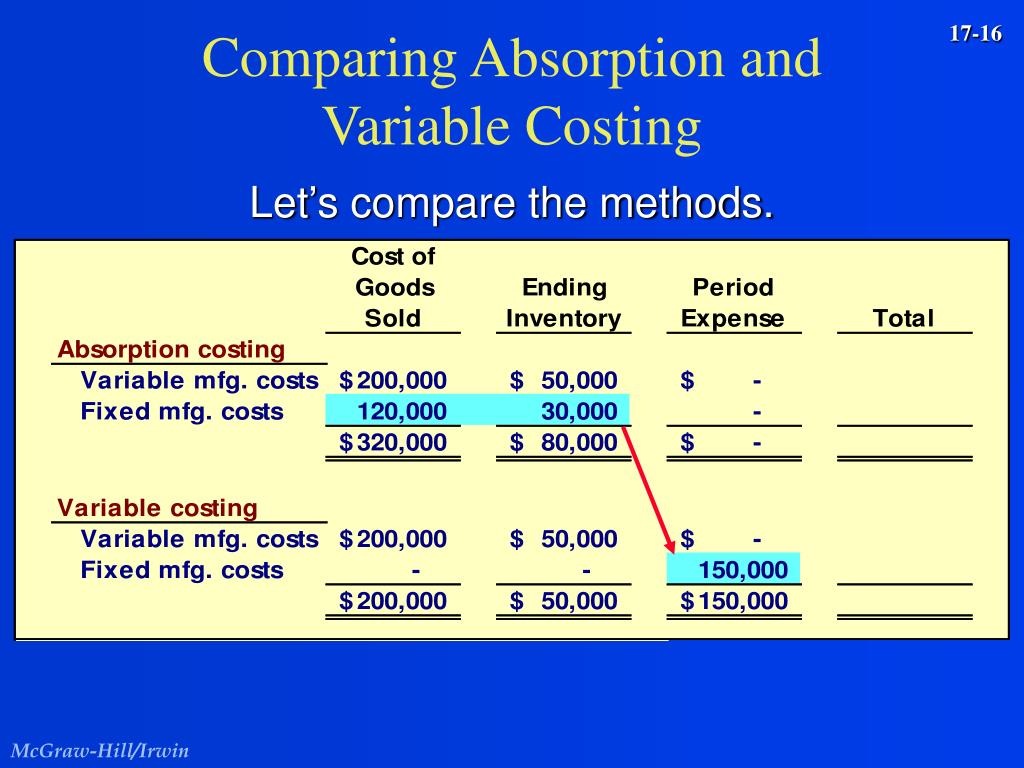

Assigning costs involves dividing the usage measure into the total costs in the cost pools to arrive at the allocation rate per unit of activity, and assigning overhead costs to produced goods based on this usage rate. Calculating absorbed costs is part of a broader accounting approach called absorption costing, also referred to as full costing or the full absorption method. Absorption costing is also often used for internal decision-making purposes, such as determining the selling price of a product or deciding whether to continue producing a particular product. In these cases, the company may use absorption costing to understand the full cost of producing the product and to determine whether the product is generating sufficient profits to justify its continued production. In contrast to the variable costing method, every expense is allocated to manufactured products, whether or not they are sold by the end of the period.

Absorption Costing Formula:

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Absorption costing is an easy and simple way of dealing with fixed overhead production costs.

- By including fixed manufacturing overheads in inventory costs, absorption costing can inflate the value of current assets, potentially altering the company’s financial ratios, such as the current ratio and inventory turnover.

- It is a very common method used widely in the business especially in the manufacturing sector, and in this way the company is able to determine the cost of individual product and services.

Allocation of Variable Manufacturing Overhead

By deferring the recognition of fixed costs, absorption costing can inflate profits in periods of increasing inventory, which may not accurately reflect the economic reality of a company’s operations. This can lead to decisions that prioritize production over market demand, resulting in excess inventory and potential write-downs in the future. Variable costs can be more valuable for short-term decision-making, giving a guide to operating profit if there’s a bump-up in production to meet holiday demand, for example. Additionally, when there is unsold inventory, absorption costing can result in higher reported profits because fixed overhead costs are deferred into inventory until the products are sold. You can calculate a cost per unit by taking thetotal product costs / total units PRODUCED.

Variable costs, such as raw materials and direct labor, fluctuate with the level of production. Under absorption costing, these costs are directly assigned to each unit of production. This means that as production increases, the variable costs increase proportionally, and these costs are only recognized as expenses when the goods are sold.

Depreciation is considered a fixed cost in absorption costing because it remains constant regardless of production levels. Under variable costing, the other option for costing, only the variable production costs are considered. Calculating usage involves determining the amount of usage of whatever activity measure is used to assign overhead costs, such as machine hours or direct labor hours used. Under generally accepted accounting principles (GAAP), U.S. companies may use absorption costing for external reporting, however variable costing is disallowed. It is to be noted that selling and administrative costs (both fixed and variable) are recurring and, as such, are expensed in the period they occurred. The disadvantages of absorption costing are that it can skew the picture of a company’s profitability.

The product costs (or cost of goods sold) would include direct materials, direct labor and overhead. Absorption costing, alsocalled full costing, is what you are used to under GenerallyAccepted Accounting Principles. Under absorption costing, companiestreat all manufacturing costs, including both fixed and variablemanufacturing costs, as product costs. Remember, total variablecosts change proportionately with changes in total activity, whilefixed costs do not change as activity levels change. These variablemanufacturing costs are usually made up of direct materials,variable manufacturing overhead, and direct labor. The productcosts (or cost of goods sold) would include direct materials,direct labor and overhead.

This requirement ensures that expenses are not prematurely deducted for tax purposes, thereby deferring tax liabilities to the period when the inventory is actually sold. The deferral of tax payments can be advantageous for cash flow management, allowing businesses to utilize funds that would otherwise be paid in taxes for other operational needs or investments. The impact of technical accounting skills on financial statements extends to the balance sheet, where inventory is a critical asset. The valuation of inventory affects not only the cost of goods sold but also the company’s current assets and overall net worth. By including fixed manufacturing overheads in inventory costs, absorption costing can inflate the value of current assets, potentially altering the company’s financial ratios, such as the current ratio and inventory turnover.

However, they still incur fixed costs such as office space rent, utilities, and salaried personnel. Absorption costing can be adapted to allocate these costs to service units or projects, thereby providing a fuller picture of the cost of delivering a service. This allocation is often based on time spent or resources used, which can help in setting prices that ensure all costs are covered. For instance, a consulting firm might allocate the cost of its analysts and office space to the hours billed to a client project.

In this example, using absorption costing, the total cost of manufacturing one unit of Widget X is $28. This cost includes both variable costs (direct materials, direct labor, and variable manufacturing overhead) and a portion of the fixed manufacturing overhead (which is allocated based on the number of units produced). It is also possible that an entity could generate extra profits simply by manufacturing more products that it does not sell.

![Daniël Klijn [LittleDean]](http://www.littledean.nl/wp-content/uploads/2018/10/cropped-Littledean-LONG-wit-1-1-1.png)