Par Value Method of Treasury Stock Disclosure, Entry, Example

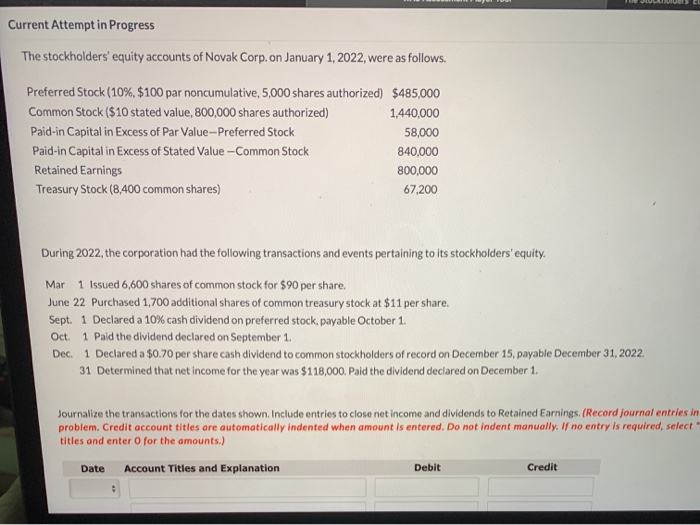

If there isno balance in the Additional Paid-in Capital from Treasury Stockaccount, the entire debit will reduce retained earnings. The company plans to issue most of the shares in exchange forcash, and other shares in exchange for kitchen equipment providedto the corporation by one of the new investors. Two common accountsin the equity section of the balance sheet are used when issuingstock—Common Stock and Additional Paid-in Capital from CommonStock.

- The two aspects of accounting for treasury stock are the purchase of stock by a company, and its resale of those shares.

- This method assumes that options and warrants are exercised at the beginning of the reporting period, and a company uses exercise proceeds to purchase common shares at the average market price during that period.

- Any difference between the reacquisition price and the selling price is either an increase in paid-in capital (if the shares sold at a gain) or a decrease in paid-in capital and/or retained earnings (if the shares sold at a loss).

AccountingTools

Here, the number of shares repurchased is equal to the option proceeds (the number of gross “in-the-money” dilutive securities multiplied by the strike price) divided by the current share price. Treasury Stock refers to a company’s own shares that it repurchases from the open market, thereby reducing the total number of outstanding shares available to investors. These repurchased shares don’t pay dividends, confer voting rights, or possess any ownership privileges.

2: Analyze and Record Transactions for the Issuance and Repurchase of Stock

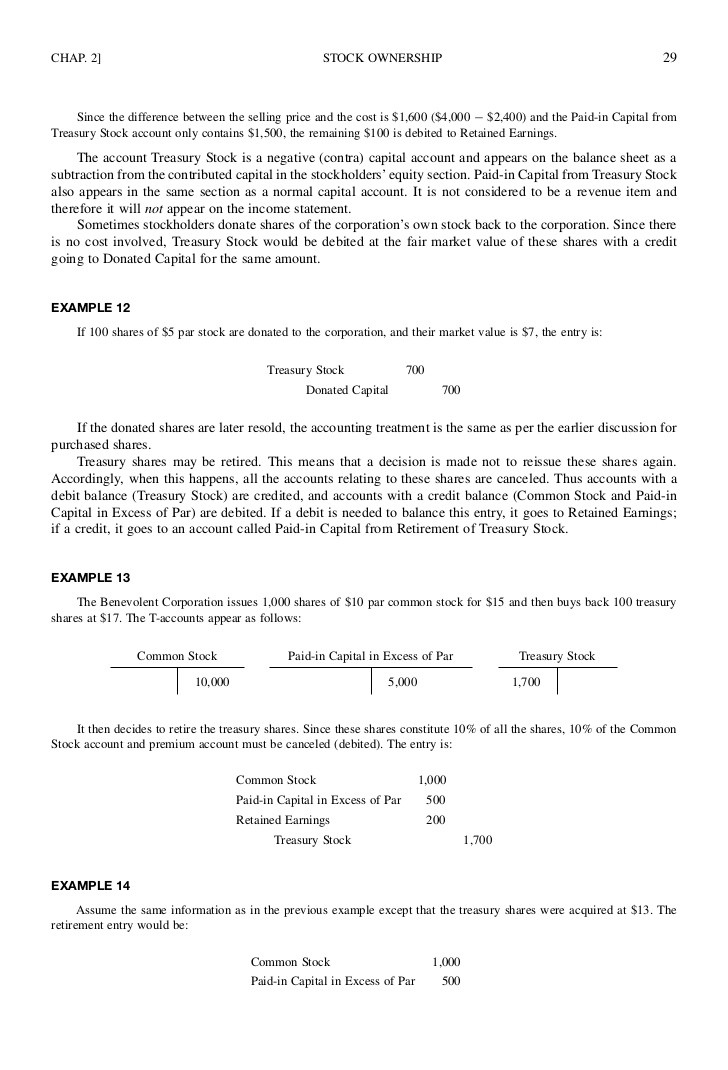

The additional 5,000 shares (the difference between 10,000 assumed issued shares, and 5,000 assumed repurchased shares) represent the net newly-issued shares resulting from the potential options and warrants exercise. In addition to not issuing dividends and not being included in EPS calculations, treasury shares also have no voting rights. The amount of treasury stock repurchased by a company may be limited by its nation’s regulatory body. In the United States, the Securities and Exchange Commission (SEC) governs buybacks. When reselling the shares, regardless of whether the company makes a gain or loss on the resale, the accounting treatment will be the same under the treasury stock par value method.

What is an additional paid-in capital (APIC)?

Finally, companies can also reacquire their shares by directly negotiating with their shareholders. The cash account is credited for the amount paid to purchase the treasury stock. Therefore, an increase in treasury stock via 3 ways to build assets a share buyback program or a one-time buyback can cause the share price of a company to “artificially” increase. Treasury Stock simply refers to shares of company stock that have been repurchased by the issuing corporation.

How confident are you in your long term financial plan?

A tender offer involves buying shares back from investors above the market price or at a premium. Companies that do direct repurchases buy shares on the secondary market, just like regular investors do. Treasury stock, also known as reacquired stock, represents shares of the company that have been reacquired from the market. Reacquiring shares decreases the number of outstanding shares in the market. A reduction in the number of outstanding shares of a company can increase the demand of the company’s shares in the market. Furthermore, it can also affect ratios such as the Earnings Per Share (EPS) ratio of the company positively, thus, further making the shares of the company attractive.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

The issued shares are treated as if they are being issued for the first time with the treasury stock account being credited instead of the share capital account. Notice on the partial balance sheet that the number of commonshares outstanding changes when treasury stock transactions occur.Initially, the company had 10,000 common shares issued andoutstanding. The 800 repurchased shares are no longer outstanding,reducing the total outstanding to 9,200 shares. If the total sales proceeds obtained from the resale of treasury stock exceed the original cash given to buy these shares back, the excess gain is taken to the additional paid-in capital account. However, in case of losses, only losses equal or below the total balance of the additional paid-in capital account are set off against the balance. If the total losses on the transaction exceeds the total balance of the additional paid-in capital account, the excess losses are set off against retained earnings account.

When shares are kept with the intention of future resale, these shares are known as treasury stock. On the shareholders’ equity section of the balance sheet, the “Treasury Stock” line item refers to shares that were issued in the past but were later repurchased by the company in a share buyback. There are a few potential benefits for companies that buy back their own shares. First, it can help to boost the value of the remaining shares by reducing the number of outstanding shares. This can make the stock more attractive to investors and help to drive up the share price. Additionally, buying back shares can be a way for companies to return money to shareholders, and it can also help to reduce the company’s overall financial risk.

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. No-par stock does not have a stated or par value per share, while par value stocks do. Second, securities laws restrict the amount of purchases and sales by the board due to the potential for manipulation, as well as their access to insider information not available to the public. Par value for a share refers to the nominal stock value stated in the corporate charter.

Note that only the securities deemed “in-the-money” are assumed to have been exercised, therefore those “out-of-the-money” are not included in the new share count. Furthermore, the EPS formula divides the net income of a company by its share count, which can be either on a basic or diluted basis. Besides options, other examples of dilutive securities include warrants and restricted stock units (RSUs).

Using the basic share count of the 100,000 common shares, the company’s basic EPS is $5 calculated as the net income of $500,000 divided by 100,000 shares. But this number ignores the fact that 10,000 shares can be immediately issued if the in-the-money options and warrants are exercised. Treasury stock refers to shares that companies buy back, thereby decreasing the number of shares outstanding. This stock can be purchased through a tender offer to investors or via a direct repurchase. Corporations may choose to hold treasury stock to raise capital later through resale, to boost shareholder interests, or to retire them completely.

![Daniël Klijn [LittleDean]](http://www.littledean.nl/wp-content/uploads/2018/10/cropped-Littledean-LONG-wit-1-1-1.png)